Strong Growth in Demand for Intellectual Property Rights in 2012

Geneva,

March 19, 2013

PR/2013/732

Press Conference ![]() Video

Video

WIPO Director General Speaks to UN-accredited Geneva Press

on IP Filings in 2012 (Photo: WIPO/Berrod).

International filings for patents, trademarks and industrial designs under WIPO-administered intellectual property (IP) systems saw continued strong growth in 2012.

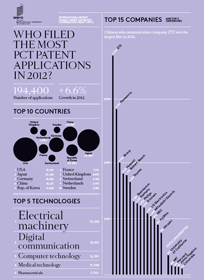

In 2012, international patent applications filed under the Patent Cooperation Treaty (PCT) grew by 6.6% on 2011.1 Japan and the United States of America (US) accounted for 48.8% of the 194,400 PCT applications filed in 2012 (Annex 1 ![]() )2. Chinese telecommunications company ZTE, with its 3,906 published PCT applications, was the largest filer in 2012.3

)2. Chinese telecommunications company ZTE, with its 3,906 published PCT applications, was the largest filer in 2012.3

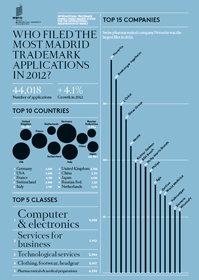

International trademark applications filed under the Madrid system grew by 4.1% in 2012.4 France, Germany and the US accounted for 36.5% of the 44,018 Madrid applications filed in 2012 (Annex 1). Swiss pharmaceutical company Novartis was the most active filer in 2012, with 176 Madrid applications.

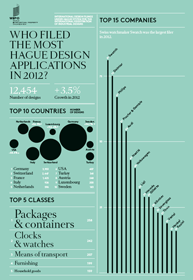

International industrial design applications filed under the Hague system grew by 3.3% on 2011.5 The 2,604 applications filed in 2012 contained 12,454 individual designs, representing 3.5% growth over 2011 (Annex 1).6 France, Germany and Switzerland accounted for 62.8% of total designs. Swatch AG of Switzerland with 81 applications was the largest filer in 2012.

“As in previous years, demand for WIPO’s international IP filing systems increased despite a weak economic climate,” said WIPO Director General Francis Gurry. “As we begin to see signs of a recovery, those companies that built strong portfolios of intangible assets during the downturn will benefit the most from new market opportunities.”

PCT system

Top PCT filing countries

Among the top 15 PCT filings countries, the Netherlands (+14.0%), China (+13.6%), the Republic of Korea (+13.4%), Finland (+13.2%) and Japan (+12.3%) saw double-digit filing growth in 2012. After two years of decline in the number of filings, the Netherlands recorded the fastest growth. China’s 2012 growth is lower than that of the previous two years; this partly reflects the sharp increase in Chinese filings since 2009, as an enlarged filing base naturally reduces relative growth rates. Canada (-6.7%), Spain (-2.4%) and Australia (-1.8%) are the three high-income countries in which fewer international applications were filed in 2012 than in 2011.

Large middle-income countries such as Turkey (-16.3%), Mexico (-15.6%), India (-9.2%), South Africa (-5.3%) and the Russian Federation (-4%) saw drops in PCT applications in 2012 after having recorded growth in 2011. Brazil is one of the few exceptions exhibiting growth in both 2011 (+15.6%) and 2012 (+4.1%).

The US (51,207) filed the largest number of PCT applications, followed by Japan (43,660), Germany (18,855), China (18,627) and the Republic of Korea (11,848). Japan (+1.1 percentage point), China (+0.6), and the Republic of Korea (+0.4) increased their respective shares of the world total, while Germany (-0.6) and the US (-0.6) saw slight decreases. Annex 2 ![]() reports data for all countries.

reports data for all countries.

Top PCT applicants

With 3,906 published applications, ZTE Corporation of China, was the largest filer of PCT applications in 2012 (Annex 3 ![]() ), followed by Panasonic Corporation of Japan (2,951), Sharp Kabushiki Kaisha of Japan (2,001), Huawei Technologies, Co. of China (1,801) and Robert Bosch Corporation of Germany (1,775). In 2012, ZTE Corporation (+1,080), Panasonic Corporation (+488) and Fujifilm Corporation (+477) saw the largest increases in PCT filings. LG Electronics Inc. of the Republic of Korea (-242) and Qualcomm Incorporated of the US (-189) saw the largest declines. The 2012 top 50 PCT filers include 20 Japanese and 15 US applicants.

), followed by Panasonic Corporation of Japan (2,951), Sharp Kabushiki Kaisha of Japan (2,001), Huawei Technologies, Co. of China (1,801) and Robert Bosch Corporation of Germany (1,775). In 2012, ZTE Corporation (+1,080), Panasonic Corporation (+488) and Fujifilm Corporation (+477) saw the largest increases in PCT filings. LG Electronics Inc. of the Republic of Korea (-242) and Qualcomm Incorporated of the US (-189) saw the largest declines. The 2012 top 50 PCT filers include 20 Japanese and 15 US applicants.

The University of California, with 351 published applications, was the largest filer among educational institutions in 2012 (Annex 4 ![]() ), followed by the Massachusetts Institute of Technology (168), Harvard University (146) and Johns Hopkins University (141). The top 50 PCT applicants for educational institutions include 27 US universities and 6 each from Japan and the Republic of Korea.

), followed by the Massachusetts Institute of Technology (168), Harvard University (146) and Johns Hopkins University (141). The top 50 PCT applicants for educational institutions include 27 US universities and 6 each from Japan and the Republic of Korea.

PCT filings by field of technology

Electronic machinery with 13,293 published applications – or 7.5% of the total – overtook digital communications (7.1%) as the field of technology in which the largest number of PCT applications were published in 2012. Computer technology (7%) and medical technology (6.4%) also accounted for large shares of total applications (Annex 5 ![]() ).7

).7

Between 2011 and 2012, all technology fields except two experienced growth in filings. IT methods for management (+22.8%) saw the fastest growth, followed by micro-structural and nano-technology (+21.2%), computer technology (+18.2%), transport (+17.5%) and electrical machinery (+17.1%).

Madrid system

Top Madrid filing countries

Germany with 6,545 filings – or 14.9% of the total – was the largest user of the Madrid system in 2012. The US (5,430) ranked second, followed by France (4,100), Switzerland (2,898) and Italy (2,787). The ranking of the top 10 countries remained unchanged, except for China which moved from sixth position in 2011 to seventh in 2012.

Among the top 15 origins, Japan (+32.9%) saw the largest growth in filings in 2012, followed by the United Kingdom (UK) (+22.4%), Turkey (21.7%), Spain (+13%) and Austria (+12.5%). There were considerable declines in Madrid filings from the Russian Federation (-8.5%), the Netherlands (-7.6%) and Germany (-7.1%). Annex 6 ![]() reports data for all countries.

reports data for all countries.

Top Madrid applicants

Novartis AG of Switzerland with 176 international applications was the top Madrid applicant in 2012 (Annex 7 ![]() ). Boehringer Ingelheim Pharma of Germany ranked second (160 applications), followed by L’Oreal of France (138), Glaxo Group of the UK (127) and Nestlé of Switzerland (105). Among the top Madrid applicants, Glaxo Group (+76), L’Oreal (+71), Boehringer Ingelheim Pharma (+62) and World Medicine of Turkey (+61) saw the largest increases in filings in 2012. BMW of Germany (-41), Janssen Pharmaceutical of Belgium (-35), Abercrombie & Fitch of Switzerland (-29) and Philip Morris of Switzerland (-22) saw the largest declines in filings. The top 30 Madrid applicant list includes 13 companies from Germany and 8 from France.

). Boehringer Ingelheim Pharma of Germany ranked second (160 applications), followed by L’Oreal of France (138), Glaxo Group of the UK (127) and Nestlé of Switzerland (105). Among the top Madrid applicants, Glaxo Group (+76), L’Oreal (+71), Boehringer Ingelheim Pharma (+62) and World Medicine of Turkey (+61) saw the largest increases in filings in 2012. BMW of Germany (-41), Janssen Pharmaceutical of Belgium (-35), Abercrombie & Fitch of Switzerland (-29) and Philip Morris of Switzerland (-22) saw the largest declines in filings. The top 30 Madrid applicant list includes 13 companies from Germany and 8 from France.

Designated Madrid members8

In 2012, the total number of designations and subsequent designations in international registrations increased by 1.3% (Annex 8 ![]() ). China was the most designated Madrid member, accounting for 6.1% of total designations, followed by the European Union (EU) and the Russian Federation (both with 5.1%), the US (5%) and Switzerland (4.1%). Among the top 10 designated members, China (+7.5%) and the Russian Federation (+6%) saw the largest growth in designations received, while Switzerland (-1.7%) was the only top 10 designated member to record a decline. Certain middle-income countries, such as Tajikistan (26.8%), Kazakhstan (18.4%), Turkmenistan (11.1%) and Mongolia (10.1%), also saw fast growth in designations received in 2012.

). China was the most designated Madrid member, accounting for 6.1% of total designations, followed by the European Union (EU) and the Russian Federation (both with 5.1%), the US (5%) and Switzerland (4.1%). Among the top 10 designated members, China (+7.5%) and the Russian Federation (+6%) saw the largest growth in designations received, while Switzerland (-1.7%) was the only top 10 designated member to record a decline. Certain middle-income countries, such as Tajikistan (26.8%), Kazakhstan (18.4%), Turkmenistan (11.1%) and Mongolia (10.1%), also saw fast growth in designations received in 2012.

Madrid international registrations by class

In submitting a trademark application, an applicant is required to specify the goods or services to which protection should apply in accordance with an international classification system known as the “Nice Classification”. The most popular classes of goods and services in international registrations recorded in 2012 were Class 9 (covering, for example, computer hardware and software) representing 9% of the total, Class 35 (covering services such as office functions, advertising and business management) which represented 7.4% of the total, Class 42 (covering services provided by for example, scientific, industrial or technological engineers and computer specialists) which represented 5.6% of the total, Class 25 (covering clothing, footwear and headgear) which represented 5.3% of the total, and Class 5 (covering mainly pharmaceuticals and other preparations for medical purposes) which represented 4.6% of the total (Annex 9 ![]() ).

).

Among the top 20 classes, the two with the highest growth rate over the previous year were Class 42 (covering services provided by, for example, scientific, industrial or technological engineers and computer specialists), which increased by 8.4%, and Class 33 (covering alcoholic beverages (except beers)), which grew by 7.3%.

Hague system

Top Hague filing countries

With 663 Hague applications containing 3,953 designs, Germany was the largest user of the Hague system, followed by Switzerland (2,447), France (1,425) and Italy (926). Among the top 15 countries of origin, Luxembourg (+156.4%) and Sweden (+94.7%) saw the most rapid growth in the number of designs filed in 2012, while the US (-68.4%), Spain (-15.2%) and Belgium (-13.2%) recorded the largest declines.9 Annex 10 ![]() reports data for all countries.

reports data for all countries.

Top Hague applicants

Swatch AG of Switzerland with 81 international design applications overtook Procter & Gamble of the US as the top applicant (Annex 11 ![]() ). Daimler AG of Germany (75) ranked second, followed by Koninklijke Philips Electronics of the Netherlands (67), Procter & Gamble Company (57) and Audi AG of Germany (54) – the latter appearing in the top Hague applicant list for the first time. Procter & Gamble filed 110 fewer applications in 2012 than in 2011. Gillette Company of the US (-27) and Vestel of Turkey (-21) also filed considerably fewer applications in 2012. Daimler AG (+20), Saverglass of France (+20), Hermes Sellier of France (+14) and Thun SPA of Italy (+14) saw the largest increases in applications. The top 25 Hague applicant list includes eight companies from Germany and six from Switzerland.

). Daimler AG of Germany (75) ranked second, followed by Koninklijke Philips Electronics of the Netherlands (67), Procter & Gamble Company (57) and Audi AG of Germany (54) – the latter appearing in the top Hague applicant list for the first time. Procter & Gamble filed 110 fewer applications in 2012 than in 2011. Gillette Company of the US (-27) and Vestel of Turkey (-21) also filed considerably fewer applications in 2012. Daimler AG (+20), Saverglass of France (+20), Hermes Sellier of France (+14) and Thun SPA of Italy (+14) saw the largest increases in applications. The top 25 Hague applicant list includes eight companies from Germany and six from Switzerland.

Designated Hague members10

The number of designs contained in designations amounted to 66,449 in 2012, an increase of 15.9% on 2011 (Annex 12 ![]() ). The EU with 9,489 designs was the most designated Hague member, followed by Switzerland (9,208), Turkey (5,381) and Ukraine (2,993). Norway – a Hague member only since 2010 – was the fifth most designated member. All top 20 designated Hague members, except Morocco and Singapore, saw growth in 2012.

). The EU with 9,489 designs was the most designated Hague member, followed by Switzerland (9,208), Turkey (5,381) and Ukraine (2,993). Norway – a Hague member only since 2010 – was the fifth most designated member. All top 20 designated Hague members, except Morocco and Singapore, saw growth in 2012.

Hague international registrations by class

Industrial design registrations relating to packages and containers for the transport or handling of goods accounted for the largest share of total registrations (Class 9; 10.6%), followed by clocks and watches and other measuring instruments (Class 10; 9.9%), means of transport or hoisting (Class 12; 8.5%) and furnishing (class 6; 8.2%). Among the top 20 classes, lighting apparatus (Class 26; +50%) and means of transport or hoisting (Class 12; +46.8%) saw the fastest growth in applications in 2012, while pharmaceutical and cosmetic products (Class 28; -35.2%) saw the largest decline (Annex 13 ![]() ).

).

Background information on the PCT, Madrid and Hague systems

PCT system

The PCT system facilitates the acquisition of patent rights in multiple jurisdictions. It simplifies the process of multiple national patent filings by delaying the requirement to file a separate application in each jurisdiction in which protection is sought. However, the decision of whether or not to grant patents remains the prerogative of national or regional patent offices, and patent rights are limited to the jurisdiction of the patent granting authority. The PCT system now has 146 member states.

For data updates and additional analysis on the performance of the PCT system in 2012, consult the PCT Yearly Review: The International Patent System in 2012, which will be published on WIPO’s Intellectual Property Statistics website in April 2013.

Madrid system

The Madrid system makes it possible for an applicant to apply for a trademark in a large number of countries by filing a single international application at a national or regional IP office of a country/region that is party to the system. It simplifies the process of multinational trademark registration by reducing the requirement to file an application at the IP office in each country in which protection is sought. The system also simplifies the subsequent management of the mark, since it is possible to record further changes or to renew the registration through a single procedural step.

For data updates and additional analysis on the performance of the Madrid system in 2012, consult the Madrid Yearly Review: International Registrations of Marks, which will be published on WIPO’s Intellectual Property Statistics website in May 2013.

Hague system

The Hague system makes it possible for an applicant to register industrial designs in multiple countries by filing a single application with the International Bureau of WIPO. By allowing the filing of up to 100 different designs per application, the system offers significant opportunities for efficiency gains. Moreover, it simplifies the process of multinational registration by reducing the requirement to file separate applications with the IP offices of each Hague member country/region in which protection is sought. The system also streamlines the subsequent management of the industrial design registration, since it is possible to record changes or to renew the registration through a single procedural step.

For data updates and additional analysis on the performance of the Hague system in 2012, consult the Hague Yearly Review: International Registrations of Industrial Designs, which will be published on WIPO’s Intellectual Property Statistics website in April 2013.

________________________________

1 The PCT system allows users to seek patent protection simultaneously in multiple jurisdictions by filing a single international patent application.

2 PCT application data are provisional as WIPO continues to receive in 2013 PCT applications that were filed with national offices in 2012.

3 For confidentiality reasons, the ranking of top applicants and the breakdown by field of technology are based on published PCT applications rather than on the number filed. Statistics based on publication date have a delay of approximately six months compared to those based on international filing date.

4 WIPO’s Madrid System for the International Registration of Marks (the Madrid system) makes it possible to register trademarks in multiple jurisdictions by filing a single international application.

5 WIPO’s Hague System for the International Registration of Industrial Designs (the Hague system) makes it possible for an applicant to register up to 100 industrial designs in multiple jurisdictions by filing a single international application.

6 A single Hague application can contain up to 100 individual designs.

7 The breakdown of published PCT applications by technology field relies on WIPO’s International Patent Classification and Technology concordance table.

8 In international applications, applicants designate countries or a region (as in the case of the EU) in which to seek protection for their trademarks.

9 Applicants domiciled in a non-member country can file applications for international registrations of industrial designs if they have a real and effective industrial or commercial establishment in the jurisdiction of a Hague member country/region.

10 In international applications, applicants designate countries or a region (as in the case of the EU) in which to seek protection for their industrial designs.

- Tel: (+41 22) 338 81 61 / 338 72 24