Unpacking the GII2024 S&T Cluster Results: Exploring Patent Technologies and Global Collaborations

August 30, 2024

Most top-ranked clusters specialize in information technology; Basel and Singapore have the highest share of foreign collaboration.

The Global Innovation Index (GII) 2024 ranks the world's top 100 science and technology (S&T) clusters, emphasizing their important contribution to national innovation systems.

This year’s GII identifies Tokyo–Yokohama in Japan as the leading S&T cluster globally, followed by Shenzhen-Hong Kong-Guangzhou (China and Hong Kong, China), Beijing (China), Seoul (Republic of Korea) and Shanghai-Suzhou (China). When combined, Tokyo–Yokohama and Shenzhen–Hong Kong–Guangzhou account for almost one in every five PCT applications filed globally.

In terms of number of clusters, China leads with 26 clusters, followed by United States (20), Germany (8), India and Republic of Korea each with four clusters.

Apart from China, seven other middle-income economies have clusters in the top 100:

- India (4 clusters): Bengaluru, Delhi, Chennai and Mumbai

- Türkiye (2): Istanbul and Ankara

- Malaysia (1): Kuala Lumpur

- Brazil (1): São Paulo

- Islamic Republic of Iran (1): Tehran

- Russian Federation (1): Moscow

- Egypt (1): Cairo

Figure 1. Top 100 S&T clusters 2024

Source: WIPO Statistics Database, April 2024 — Pink points refer to top 100 S&T clusters. Blue-white points (noise) refer to all inventor/author locations not classified in a cluster.

Computer technology & digital communications are leading patented technologies among the top 100 S&T clusters

Looking at only the PCT applications within the top 100 S&T clusters, the following 10 patent technology fields account for just over 60% of all technology fields: Computer technology (12.0%), Digital communication (11.5%), Electrical machinery, apparatus, energy (6.6%), Medical technology (6.5%), Audio‑visual technology (4.7%), Measurement (4.6%), Pharmaceuticals (4.5%), Semiconductors (3.8%), Biotechnology (3.5%) and Transport (3.3%). The tool below can be used to explore the technology fields of individual clusters further.

The San Diego cluster is mostly concentrated in Digital communication (45.5%), the Seattle cluster is highly concentrated in Computer technologies (43.2%) – almost twice the size of the next largest cluster (Hangzhou, 27.2%), the Cincinnati cluster is mainly concentrated in Medical technologies (41.5%), while the Houston cluster has close to a third in Civil engineering technologies – with a concentration that is 3x larger than the next largest cluster (Brisbane, 9.6%).

Nearly half of the Boston–Cambridge cluster (49.9%) is comprised of biotechnologies, medical technologies and pharmaceutical technologies. This is closely followed by the Cincinnati (48.4%), Raleigh (43.7%), Philadelphia (40.8%) and Copenhagen (40.2%) clusters.

Figure 2. Share of PCT technology fields in top 100 clusters

Collaboration with foreign innovation actors is high among the top 100 S&T clusters

Collaboration in research and development (R&D) is essential for tapping into diverse expertise, driving innovation, sharing resources, mitigating risks, and accelerating progress. It broadens networks, offers quality control, and provides access to specialized facilities. In essence, R&D collaboration is a vital catalyst for efficiency and innovation.

Using the top 100 S&T cluster dataset we can get an idea of the level of foreign collaboration prevalent within these clusters. In table 1, foreign collaboration is measured based on the number of unique patent applications (or publications) from within a cluster that has at least one other inventor (or author) listed outside that cluster’s economy. We further explore these relationships for the top clusters with the greatest share of foreign collaboration, shown below.

Patents

Publications

The Basel cluster, ranking 96 in the top 100, has the highest share of foreign collaboration in both PCT applications and publications. There are 4,053 PCT applications published between 2019 and 2023 with at least one inventor located in the Basel cluster, of which, 1,451 also had a co-inventor whose address was listed outside of Switzerland (a foreign collaboration share of 35.8%). For publications, the share of foreign collaboration with the Basel cluster is even higher at 69.8% of all the scientific articles published between 2019 and 2023.

The Singapore cluster has the second highest share of publications with foreign collaboration, having over 49K scientific articles published with at least one international co-author. Singapore also has the 4th highest share of foreign collaboration in its PCT applications among the top 100 clusters.

The tool below can be used to further explore the foreign collaboration of clusters and more specifically how they link with external economies, for both patents and publications (see Figure 4 for further details[1]).

Figure 3. Foreign collaboration among the top S&T clusters

Background

The WIPO top 100 Science and Technology (S&T) Cluster ranking, identifies local concentrations of world-leading science and technology activity. S&T clusters are established through the analysis of patent-filing activity and scientific article publication, documenting the geographical areas around the world with the highest density of inventors and scientific authors. Further cluster information can also be found in our new cluster briefs found on our S&T Cluster ranking page.

For this analysis, two foreign collaboration measures are used. The first is used in table 1, focusing on the presence of foreign collaboration on a patent or article. If at least one of the co-inventors (or co-authors) is located outside the given cluster’s economy, then that PCT application (or publication) is counted as a foreign collaboration.

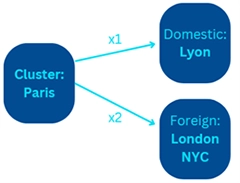

The second method, used in figure 5, goes one step further by establishing the specific economies where the co-inventors and co-authors are located and aggregating those collaborative links by those economies. A collaborative link is measured by first identifying the patents and publications within each cluster that have at least one inventor or author outside that specific cluster, and then counting the number of unique collaborative links by location. Domestic collaboration occurs when an inventor or researcher collaborates outside their own cluster, but locally within the same economy, while foreign collaboration occurs outside the local economy.

For example: A journal publication has 6 authors listed: 1 living in the Paris cluster, 2 in France but not in the Paris cluster, 1 in the US and 2 living in the UK. The Paris cluster would then have 1 domestic link with France and 2 foreign links: 1 with the UK and 1 with the US.

Figure 4. Measuring collaborative links

The level of collaboration among the science and technology related journal publications and patents can vary greatly. Scientific research is often a collective endeavor, involving collaboration between researchers, institutions, and even nations to advance knowledge and share discoveries. In contrast, patent applications are typically driven by commercial interests, where inventors or companies seek to protect their intellectual property for economic gain.