Sluggish High-tech Trade; Reshoring and Supply Chain Disruptions at Stake

December 21, 2022

In 2022, overall high-tech trade has increased at a lesser pace than overall trade in goods and merchandise, according to analysis updating earlier findings in the Global Innovation Index 2022, and drawing on data from Trade Data Monitor.

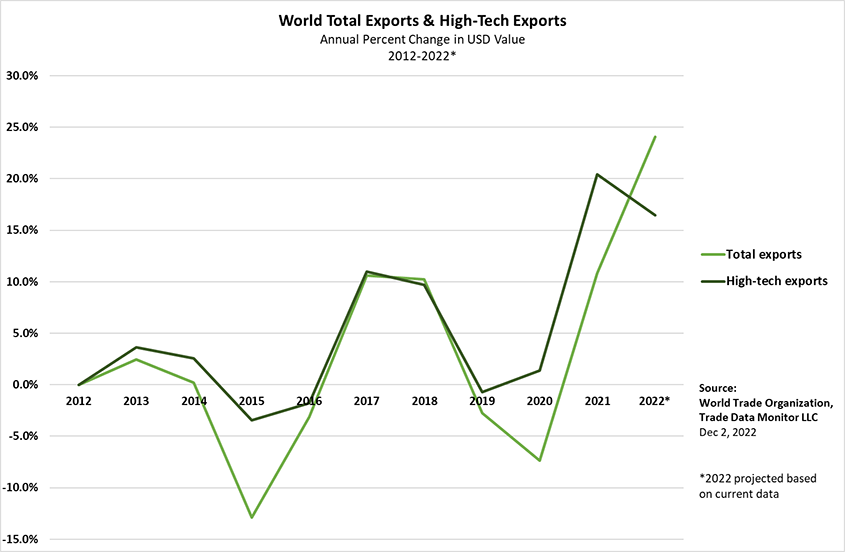

While both high-tech trade and overall merchandise trade experienced unusually high growth in 2022 as they recovered from the depths of the COVID-19 pandemic, this is the first time this century that they have diverged as strongly: high-tech trade has not grown as fast as overall goods trade, suggesting that global high-tech trade is facing some new barriers.

Overall trade recovered fully from the COVID-19 pandemic and increased 24.1% to US 24.2 trillion an annualized basis from USD 19.5 trillion, while trade in high-tech goods, rose 16.5% to USD 4.4 trillion from USD 3.75 trillion.

As the figure 1 below shows, during the high-tech boom, trade in high-tech goods, which has boomed this century, has always outpaced trade in total products until this year.

Figure 1

Supply chains are diversifying. Countries and companies are attempting to source goods closer to home, a trend known as nearshoring. At the same time, ongoing geopolitical troubles have dampened high-tech global trade growth.

The development of new sectors, particularly in the manufacturing of renewable energies, batteries and electric vehicles, helps mitigate the high-tech growth slump though.

The United States of America (U.S.) sees a change in the structure of its high-tech trade flows

The U.S. was one of the top economies, along with Singapore, the Republic of Korea, the Netherlands, Malaysia, France and Viet Nam, to increase high-tech exports, by 7% year-on-year to USD 233 billion.

Yet, the structure of US high-tech trade flows is changing. In the first 9 months of 2022, for example, U.S exports of processors and integrated circuits to China fell 34.2% to USD 5.1 billion, while shipments of those products to Mexico increased 11.8% to USD 6.9 billion.

The U.S.’s top market for overall high-tech exports was Mexico, where shipments rose 16.5% to USD 36.7 billion.

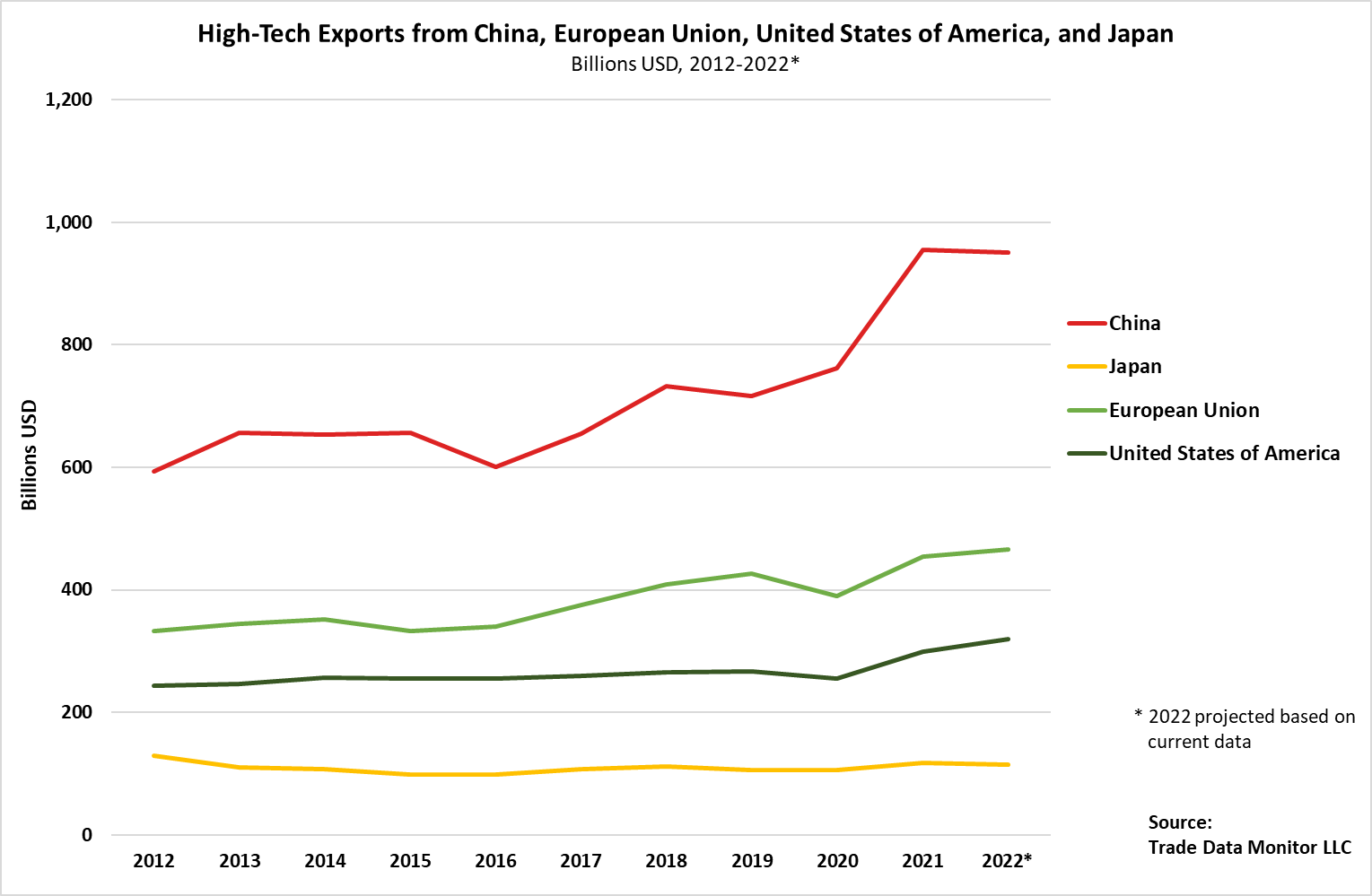

China’s Slowing Global High-Tech Exports

In return, in the first 10 months of 2022, Chinese high-tech exports fell 1.3% to USD 745.6 billion from USD 755.5 billion.

The biggest reason was a decline in exports to countries that are part of China’s broad network of manufacturing supply chains. Exports to Viet Nam declined 11.7% to USD 26.8 billion. Shipments to Mexico fell 18% to USD 13.1 billion.

As we see in figure 2, despite the decline, China still dominates high-tech exports.

Figure 2

In particular, China is still leading in smartphone exports, the industry’s flagship consumer good, shipping out USD 114.8 billion in 2022, its number one high tech export. Its second-ranked product was data processing machines. Another important new category, solar panels, was worth USD 36.9 billion, signaling a strong economy in renewable energy.

China’s top high-tech export market was the U.S., where its shipments increased 6.2% to USD 128 billion.

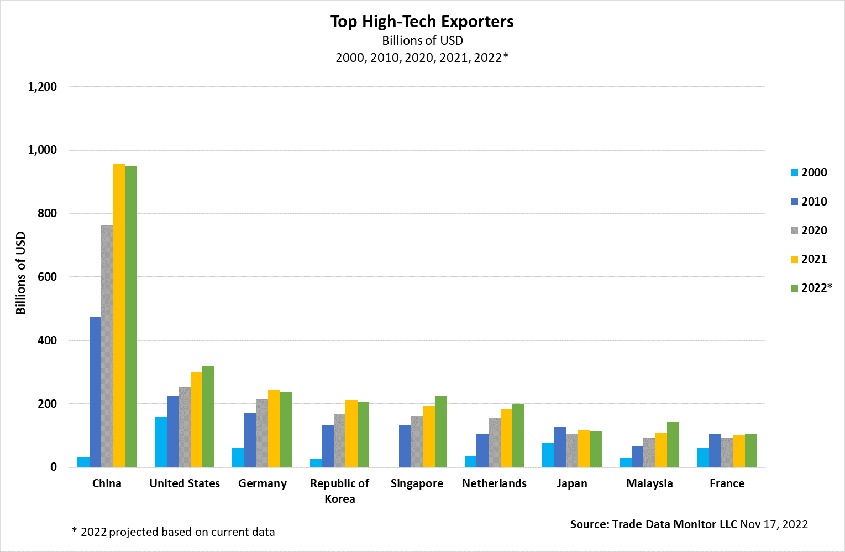

Other Asian countries – Malaysia, Singapore, Thailand, and Viet Nam - are asserting themselves in high-tech

New pan-Asian supply chains are emerging beyond Chinese production locations.

As figure 3 shows, five of the world’s top 10 high-tech exporters are now Asian.

Beyond, China, the Republic of Korea, and Japan, high-tech exports are soaring from Malaysia, Singapore, Thailand, and Viet Nam. Malaysia’s exports increased 32.1% to USD 102.3 billion, for example.

Figure 3

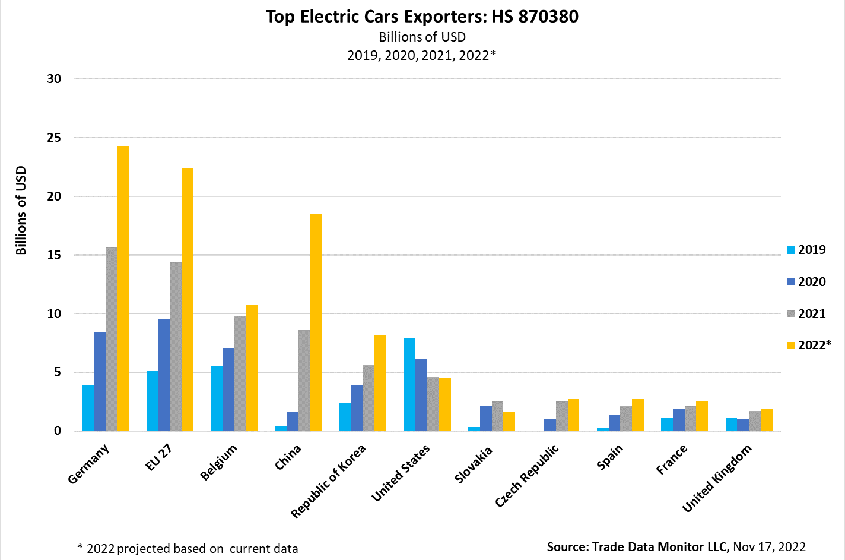

Electric vehicle trade fuels high-tech trade

The world’s efforts to decarbonize economies combined with developments in battery technology are boosting global trade in electric vehicles.

Germany is emerging as the dominant player on the global market for electric vehicles. Its exports rose 55.4% to USD 16.4 billion in the first nine months of 2022. China is number two, with shipments increasing 115.4% to USD 11.8 billion. U.S. exports declined 1.9% to USD 3.8 billion.

That boom in electric vehicle trade has boosted shipments of materials related to making batteries needed for electric cars and trucks.

Exports of lithium batteries by their top supplier, China, increased 83.4% to USD 34.9 billion in the first nine months of 2022 from USD 19 billion over the same time in 2021.

As figure 4 illustrates, electric car exports are thriving around the world.

Figure 4

Background

The Global Innovation Index (GII) uses two indicators on high-tech trade which are obtained thanks to a collaboration with Trade Data Monitor, and access to the United Nations Comtrade Database; the World Trade Organization and United Nations Conference on Trade and Development. Trade Data Monitor specializes in providing trade data for economic research. It obtains, processes, and publishes customs data from national governments around the world, for monthly publication.