Par James Nurton, rédacteur indépendant

D’après le Global Intangible Finance Tracker (outil de suivi mondial des actifs incorporels) de Brand Finance, la valeur mondiale des actifs incorporels est passée de 61 000 milliards de dollars É.-U. en 2019 à 74 000 milliards de dollars É.-U. en 2021. En outre, il ressort des recherches menées par Ocean Tomo que les actifs incorporels représentent 90% de la valeur des entreprises du S&P 500. Pourtant, de nombreuses entreprises riches en actifs de propriété intellectuelle, en particulier des start-up et de petites et moyennes entreprises (PME), peinent à obtenir des financements. Comment cela s’explique-t-il? En partie par la difficulté qu’ont les investisseurs à valoriser et à analyser les actifs incorporels (tels que le savoir-faire et les données) par rapport aux actifs matériels (corporels) tels que les biens immobiliers, les machines et les stocks.

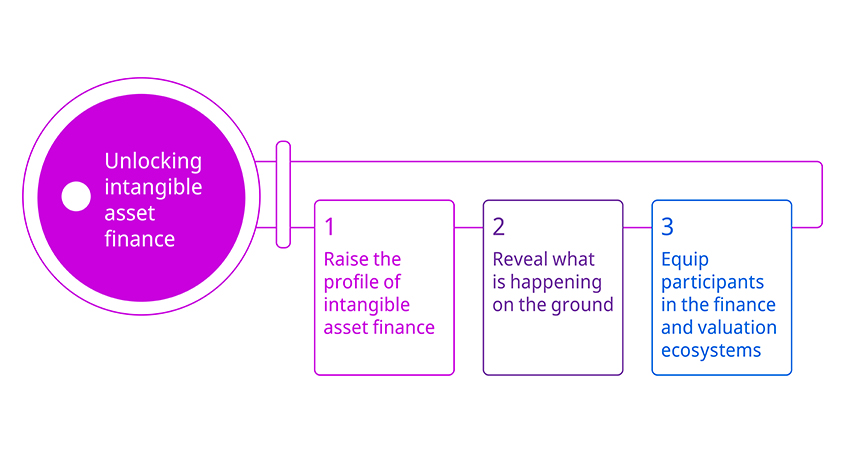

Par conséquent, trouver des moyens de débloquer le financement par les actifs incorporels, et résoudre le problème du financement par la propriété intellectuelle, devient une priorité à l’échelle mondiale. En novembre 2022, l’OMPI a organisé un dialogue de haut niveau sur le sujet et a présenté un plan d’action en trois volets visant à : 1) faire mieux connaître le financement par les actifs incorporels; 2) présenter la situation sur le terrain; et 3) former les parties prenantes des écosystèmes du financement et de la valorisation.

Trouver des moyens de débloquer le financement par les actifs incorporels, et résoudre le problème du financement par la propriété intellectuelle, devient une priorité à l’échelle mondiale.

Comme l’a déclaré le Directeur général de l’OMPI, Daren Tang, lors de l’allocution d’ouverture du dialogue de haut niveau : “les actifs incorporels sont la matière noire de notre monde financier : entourés de mystère et en bonne partie invisibles, alors même qu’ils exercent aujourd’hui une influence considérable et de plus en plus tangible sur nos entreprises et nos économies”.

Il est réjouissant d’observer que plusieurs initiatives émanant du secteur privé comme du secteur public visent aujourd’hui à débloquer des possibilités de financement adossé à des actifs de propriété intellectuelle. BDC Capital, la branche investissement de la Banque de développement du Canada, la banque des entrepreneurs canadiens, mène l’une de ces initiatives.

L’approche de BDC Capital

En juillet 2020, BDC Capital a annoncé la création d’une enveloppe de 160 millions de dollars canadiens (119 millions de dollars É.-U.) pour le financement du développement de la propriété intellectuelle, la première du genre au Canada, afin de mettre des financements compris entre 3 et 10 millions de dollars canadiens à la disposition d’entreprises canadiennes. Depuis son lancement, le fonds a reçu quelque 1500 demandes et a conclu 15 accords.

Lally Rementilla, associée directrice, est à la tête de l’équipe chargée du financement sur actifs de propriété intellectuelle de BDC Capital, composée de huit personnes. Mme Rementilla a rejoint la banque avec son équipe après avoir quitté Quantius, un prêteur commercial alternatif de Toronto, qu’elle avait intégré en 2015, après avoir travaillé pour des entreprises telles que Lucent et Lavalife. Sous son mandat de directrice financière puis de directrice générale de Quantius, l’entreprise a investi dans des entreprises innovantes et riches en actifs de propriété intellectuelle, telles que Baanto International, Acerus et Lambda Solutions.

de la BDC (Banque de développement du Canada)

a annoncé la création d’un fonds de 160 millions de

dollars canadiens (119 millions de dollars É.-U.) pour

soutenir le financement adossé à des actifs de

propriété intellectuelle. L’équipe chargée du

financement sur actifs de propriété intellectuelle de

BDC Capital, composée de huit personnes, est menée

par Lally Rementilla, associée directrice, qui est très

enthousiaste quant à l’avenir de ce type de financement.

(Photo : avec l’aimable autorisation de Lally Rementilla)

“En 2015, personne ne savait vraiment ce qu’était le financement adossé à des actifs de propriété intellectuelle : la seule possibilité qui s’offrait aux PME était le financement de contentieux”, explique Lally Rementilla, qui a constaté l’inefficacité des marchés de capitaux et les difficultés que les entreprises innovantes rencontrent pour lever des fonds. “Ces entreprises possédaient des brevets, du savoir-faire, des logiciels, des données et des contrats avec des clients, mais les marchés ne leur attribuaient aucune valeur”.

L’approche de Mme Rementilla a consisté à former une équipe qui soit en mesure de valoriser et d’analyser correctement les actifs incorporels, y compris les droits de propriété intellectuelle enregistrés, tels que les brevets et les marques, et d’autres actifs, tels que les secrets d’affaires, les logiciels, les données et les algorithmes. Elle explique qu’il s'agit d’“analyser en profondeur le portefeuille de propriété intellectuelle d'une entreprise”. “Nous ne prenons pas uniquement en considération la valeur attribuée au portefeuille de propriété intellectuelle. Nous voulons également savoir comment elle crée un appel d’air autour de l’entreprise pour offrir une plus grande part de marché et une valeur accrue aux investisseurs ou acquéreurs potentiels”.

L’équipe de BDC Capital comprend des spécialistes des affaires, de la technologie et de la propriété intellectuelle qui travaillent en étroite collaboration pour évaluer et analyser chaque possibilité d’investissement. Tous les aspects sont passés en revue, de l’équipe à l’origine de la technologie à la stratégie de gestion, en passant par le marché potentiel et la position des concurrents.

Nous ne prenons pas uniquement en considération la valeur attribuée au portefeuille de propriété intellectuelle. Nous voulons également savoir comment elle crée un appel d’air autour de l’entreprise pour offrir une plus grande part de marché et une valeur accrue aux investisseurs ou acquéreurs potentiels.

Lally Rementilla

Ce que les investisseurs veulent savoir

Dans le cadre du financement adossé à des actifs de propriété intellectuelle, l’une des priorités tient à ce que Lally Rementilla appelle “un alignement clair entre la stratégie de l’entreprise et la stratégie de propriété intellectuelle”. Cela signifie que les entreprises doivent être en mesure de présenter les actifs de propriété intellectuelle dont elles sont titulaires (y compris des informations précises sur les dépôts de demandes de titres de propriété intellectuelle et les titres délivrés), le lien entre ces actifs et leurs produits et services essentiels ainsi que leurs sources de revenus, et la raison pour laquelle elles apportent une proposition de valeur unique sur leur marché. “Certaines entreprises ne sont pas prêtes pour cela”, dit-elle.

Pour obtenir un financement, les entreprises doivent être en mesure de faire la preuve de leur proposition de vente unique sur leur marché et de devenir une entreprise phare dans leur secteur à l’échelle mondiale, de préférence en s’appuyant sur des données probantes. Mme Rementilla ajoute que BDC Capital n’assume pas le risque technologique, de sorte que les entreprises doivent déjà être à l’étape de la commercialisation de leur innovation, ou en être proches.

Les entreprises qui cherchent à obtenir un financement devraient également être disposées à recevoir des commentaires de la part des investisseurs. Selon Mme Rementilla, la valorisation de la propriété intellectuelle évolue en fonction du progrès technologique et de sa commercialisation. C’est pourquoi BDC Capital continue de suivre l’évolution des portefeuilles de propriété intellectuelle au fil du temps et demande généralement des rapports deux fois par an. Ce suivi peut aboutir à une actualisation des valorisations. Qui plus est, il peut aussi donner lieu à de nouvelles observations, car chaque portefeuille est examiné au regard notamment de la nécessité d’effectuer davantage de recherches sur l’état de la technique, d’analyser le paysage de la propriété intellectuelle de manière plus régulière, d’actualiser la connaissance de la position des concurrents, de l’existence de nouvelles possibilités d’octroi de licences de technologie ou de fusions et d’acquisitions, etc.

En ce qui concerne les investissements, BDC Capital n’opère aucune distinction quant à la technologie concernée. Ses 15 premières transactions ont porté sur un large éventail d’entreprises canadiennes, mais les secteurs les plus populaires ont été les soins de santé, la durabilité et les solutions d’entreprise. L’une de ses transactions les plus réussies, avec Novarc Technologies, une entreprise de robotique ayant son siège à Vancouver, a été la toute première à être annoncée.

Le financement par la propriété intellectuelle peut avoir un effet catalyseur sur d’autres investissements

Novarc est spécialisée dans la conception et la commercialisation de robots collaboratifs (“cobots”) pour l’industrie, en particulier pour le soudage. Fondée en 2013, elle a enregistré une croissance de 1235% entre 2016 et 2019 et s’est classée au 45e rang des entreprises canadiennes affichant la plus forte croissance en 2020. Elle a élargi ses activités de l’Amérique du Nord à l’Asie, en passant par l’Europe et le Moyen-Orient.

L’un des points forts de Novarc est l’utilisation de l’intelligence artificielle et de la robotique pour fournir des solutions automatisées afin d’aider les soudeurs dans les ateliers de fabrication de tuyaux - une activité qui devient essentielle en raison de la pénurie mondiale de soudeurs qui se profile à l’horizon. Depuis le début de son développement, Novarc a mis l’accent sur la protection de sa propriété intellectuelle et de ses actifs incorporels, notamment en déposant des demandes de brevet.

En février 2021, BDC Capital a annoncé avoir fourni à Novarc un capital de croissance de 2,6 millions de dollars canadiens. Le PDG et cofondateur de la société, Soroush Karimzadeh, a déclaré lors de l’annonce que le fonds de propriété intellectuelle “est un produit unique sans effet dilutif que nous n’avions pas dans l’écosystème de financement au Canada. Il peut aider à jeter un pont entre les rondes de prédémarrage et d’investissement stratégique et la rentabilité”.

Selon Mme Rementilla, il est ressorti très nettement de l’analyse menée par BDC Capital que le portefeuille de propriété intellectuelle de Novarc “permettait à l’entreprise de se différencier sur le marché”. Cette dernière disposait également d’une plateforme logicielle puissante et de la capacité de collecter des données sur la manière dont les soudeurs effectuent différents types de travaux, ce qui lui conférait un avantage concurrentiel important pour le développement d’algorithmes et de produits.

Elle ajoute que l’expérience de Novarc illustre bien la manière dont le financement adossé à des actifs de propriété intellectuelle peut “servir de moteur à l’investissement du secteur privé”. En septembre 2022, Novarc a reçu un financement de série A de Graham Partners Growth, la stratégie de capital de croissance de la société privée d’investissement Graham Partners. Lors de l’annonce de cet investissement, la société a déclaré qu’elle estimait que “la combinaison de matériel et de logiciels exclusifs permet à Novarc de se positionner comme fournisseur privilégié de solutions de soudage de tuyaux fondées sur l’intelligence artificielle dans toute une série de marchés finaux”.

En permettant à Novarc d’investir davantage dans la recherche-développement, le financement de BDC Capital a donc ouvert la voie à d’autres possibilités de financement. Mme Rementilla souligne que les investisseurs publics et privés ont de bonnes raisons de travailler ensemble et qu’une telle coopération devrait être encouragée. Les fonds de capital-risque, par exemple, peuvent apporter des compétences techniques et sectorielles spécialisées qui dépassent les ressources dont disposent les banques de développement.

Novarc est aujourd’hui en pleine expansion. Elle figure dans le classement des entreprises affichant la croissance la plus rapide sur le continent américain en 2022 établie par le Financial Times, ainsi que des 50 entreprises manufacturières de pointe privées les plus prometteuses au monde réalisé par CB Insights.

Un avenir plus radieux

Avec 15 contrats signés à ce jour, Mme Rementilla se dit “très optimiste” quant à l’avenir du financement adossé à des actifs de propriété intellectuelle en tant que moyen durable d’accès au financement pour les entreprises à forte intensité d’actifs incorporels, qui fait de plus en plus d’adeptes : “Le débat s’intensifie et gagne en substance, et nous observons un alignement entre les pouvoirs publics et le secteur privé. Nous n’avons plus l’impression de devoir monter au créneau! Les gens en parlent et se demandent comment le mettre en pratique pour soutenir la créativité et l’innovation, ce qui suscite beaucoup plus d’intérêt à l’égard de la propriété intellectuelle”.

Ainsi, AON, l’une des principales sociétés mondiales de services financiers, dispose d’une équipe chargée spécialement de la stratégie et de la valorisation de la propriété intellectuelle et des solutions en matière de risque dans ce domaine. Au cours de l’année qui vient de s’écouler, elle a facilité l’obtention d’un financement de 50 millions de dollars É.-U. par Anonos, spécialiste de la confidentialité des données, et la conclusion d’un accord de 35 millions de dollars É.-U. par GRUBBRR, fournisseur de technologies de commande en libre service, au moyen d’une structure de dette garantie par la propriété intellectuelle.

Le financement adossé à des actifs de propriété intellectuelle est encouragé dans des pays aussi variés que la République de Corée et le Portugal, où l’initiative Inovadora COTEC attribue des notes aux entreprises en se fondant sur des facteurs tels que les capacités d’innovation et la propriété intellectuelle. Plus de 800 entreprises ont déjà été évaluées dans le cadre de ce système.

En septembre 2021, la société japonaise de biotechnologie Spiber (qui fabrique des tissus ne contenant pas de substances animales, comme la soie d’araignée artificielle) a levé 311 millions de dollars É.-U. lors d’un cycle de financement mené par la société de capital-investissement Carlyle, après avoir obtenu un premier financement de 183 millions de dollars É.-U. Et il ne s’agit pas seulement de brevets et de technologies : en juillet 2020, American Airlines a obtenu un prêt de 1,2 milliard de dollars É.-U. auprès de la banque d’investissement Goldman Sachs, dont 1 milliard était garanti par les droits attachés à ses marques et noms de domaine.

Mme Rementilla se félicite des progrès accomplis et déclare qu’une coopération internationale accrue serait indiquée. L’OMPI en fait une priorité dans le cadre de son plan d’action, qui contribuera au partage de connaissances au-delà des frontières nationales et à la promotion de nouvelles approches en matière de financement.

La technologie est également appelée à transformer l’analyse des entreprises et de leurs portefeuilles de propriété intellectuelle à la faveur de l’application de l’intelligence artificielle. “En 2015, il aurait fallu six semaines et des dizaines de milliers de dollars pour obtenir une évaluation par un tiers. Aujourd’hui, l’analyse de données et l’apprentissage automatique permettent un plus grand degré d’automatisation de ces tâches”, explique Mme Rementilla.

La technologie est également appelée à transformer l’analyse des entreprises et de leurs portefeuilles de propriété intellectuelle à la faveur de l’application de l’intelligence artificielle.

Grâce à une coopération internationale accrue, un meilleur partage des connaissances entre les différents acteurs du secteur et une utilisation plus importante des outils de valorisation et d’analyse fondés sur l’intelligence artificielle, le financement adossé à des actifs de propriété intellectuelle pourrait enfin devenir accessible aux entreprises de différentes tailles et à différents stades de leur cycle de vie. C’est une bonne nouvelle pour les innovateurs, les investisseurs et toutes les personnes qui bénéficient de la commercialisation d’actifs incorporels, et cela permettrait aux écosystèmes d’innovation à travers le monde de croître et d’évoluer.

À propos du Plan d’action de l’OMPI pour le financement par la propriété intellectuelle

En novembre 2022, l’OMPI a lancé son Plan d’action pour le financement par la propriété intellectuelle, qui vise à rendre le financement par les actifs incorporels (l’utilisation de la propriété intellectuelle et d’autres actifs incorporels comme source de financement) “plus accessible”, selon Marco Alemán, sous-directeur général de l’OMPI.

Ce plan repose sur trois volets principaux. Le premier vise à faire mieux connaître le financement par les actifs incorporels, en soulignant l’importance qu’il revêt aux fins de la réussite économique de toutes les parties. Cet objectif sera atteint grâce à la mise en place de lieux de discussion, tels que le Dialogue de haut niveau sur le déblocage des financements garantis par des actifs incorporels, qui réunissent des parties prenantes des secteurs public et privé dans les domaines de la finance, des affaires et de la propriété intellectuelle, et grâce à la création de groupes consultatifs de spécialistes chargés d’approfondir les questions essentielles. Le premier dialogue de haut niveau a eu lieu en novembre 2022 et le deuxième est prévu en novembre 2023.

Le deuxième volet du plan d’action est axé sur la constitution d’une base de données probantes. Une série de rapports nationaux apportera des points de vue éclairés sur la manière dont la propriété intellectuelle est utilisée pour rendre le financement plus accessible. Ces rapports permettent également d’amorcer des discussions sur le financement par la propriété intellectuelle au sein et en dehors de la communauté de la propriété intellectuelle. D’autres projets de recherche sont prévus, notamment des études sur les tendances commerciales dans les industries de la création.

Le troisième volet vise à aider les parties prenantes à obtenir un financement par emprunt et par capitaux propres grâce à leur propriété intellectuelle, en leur fournissant un ensemble d’outils pratiques. Il s’agit notamment d’une boîte à outils destinée à aider les emprunteurs, les prêteurs et les investisseurs à communiquer plus efficacement avec les bailleurs de fonds. Dans le cadre de ce volet du plan d’action, il sera également question des moyens d’améliorer la transparence en ce qui concerne la titularité et les transactions de propriété intellectuelle, afin de faciliter les relations et les échanges nécessaires au bon fonctionnement du financement par le la propriété intellectuelle.