End of Year Edition – Against All Odds, Global R&D Has Grown Close to USD 3 Trillion in 2023

2024年12月18日

Research and Development (R&D) stands as a cornerstone of innovation, a true barometer of progress and creativity.

To close out 2024 on an inspiring note, the Global Innovation Index (GII) team has delved deep into a wealth of data from diverse sources to deliver the freshest insights on global R&D activity. These findings not only spotlight key global trends but also unveil unique country-specific narratives.

While many economies continue to grapple with the challenge of adequately funding their innovation ecosystems, the latest data carries an uplifting message: the momentum of innovation is alive and thriving across the globe.

Global R&D trends – How have global R&D levels and evolved?

Stylized Fact 1: Defying Challenges, Global R&D Has Tripled in real Terms Since 2000

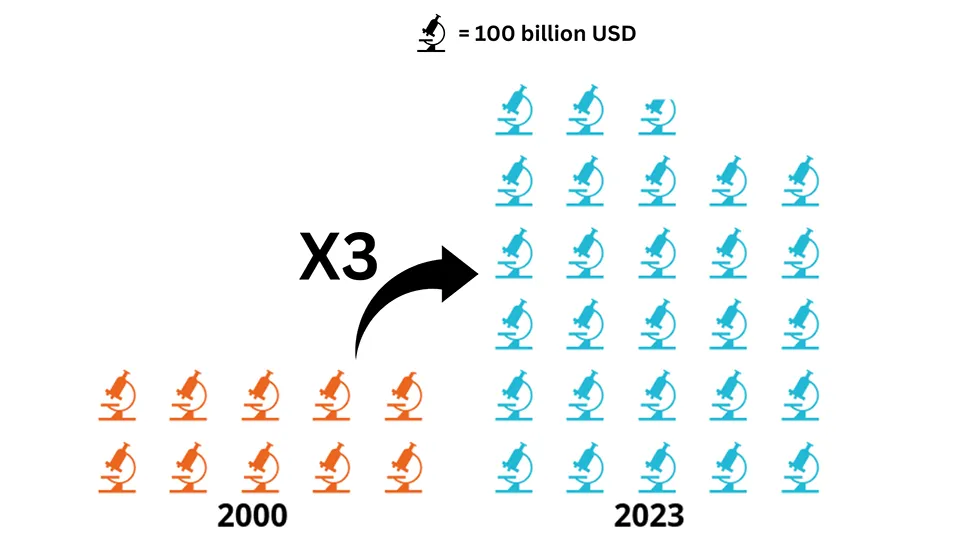

Despite three major economic crises, a pandemic, and ongoing geopolitical tensions, global R&D in real terms has nearly tripled – from approximately USD 1 trillion in 2000 to over USD 2.75 trillion in 2023. (See Chart 1)

Chart 1: Global R&D, in USD trillion, 2000 VS 2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Stylized Fact 2: A Significantly More R&D-Intensive Global Economy Emerges

Despite rapid global GDP growth since 2000, the share of R&D in total GDP has increased from under 1.5% to nearly 2% by 2023. This reflects a significant shift toward a more R&D-driven global economy. With a world GDP of around USD 200 trillion in 2023, an 0.5% increase as share of GDP translates into a whooping additional USD 1 R&D trillion spent. (See Chart 2)

Chart 2: Global R&D growth, in USD trillion and as % of GDP

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Stylized Fact 3: The Global R&D Landscape Shifts Toward Asia and – a little – towards Africa

Between 2000 and 2023, global R&D expenditure has undergone a significant geographic shift. Asia now accounts for about 46% of global R&D in 2023, reflecting a pronounced increase from 25% in 2000. In 2023, the Southeast Asia, East Asia, and Oceania (SEAO) region has emerged as the largest R&D-spending region, accounting for about 40% of global R&D. This region includes China, Japan, the Republic of Korea, and Southeast Asian economies like Indonesia and Thailand – with Japan being the only one trending down over time. (See Chart 3)

Northern America (the US and Canada), the global leader in 2000, now holds 29% of global R&D, followed by Europe (21%) and Central and Southern Asia (3%), which includes a rising India.

Chart 3: Regional shares of global R&D, in %, by region

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information). SSA refers to Sub-Saharan Africa, NAWA to Norther African and Western Asia, LAC to Latin America and the Caribbean, SEAO to Southeast Asia, East Asia, and Oceania, and CSA to Central and Southern Asia

Latin America and the Caribbean (LAC), in turn, have seen their share decline from 3% to 2% between 2000 and 2023. In Latin America, Brazil, the region’s largest contributor, saw its share fall from 2% in 2000 to 1.3% in 2023. Argentina and Mexico also experienced declines. For a complete picture of all economies, please see Annex Table 1 in the Background section.

Northern Africa and Western Asia (NAWA) have increased their shares, moving from 2% in 2000 to almost 4% in 2023, whereas Sub-Saharan Africa (SSA) has had a steady global share. In Northern Africa, Egypt stands out with an impressive increase, rising from 0.1% of global R&D in 2000 to 0.6% in 2023, a success story to watch closely. In terms of absolute R&D spending in African economies, Egypt also stands out as a clear leader in Africa, with R&D spending experiencing a significant surge since 2007 – reaching over 15 billion USD (PPP-adjusted 2015 prices) in 2023. Algeria, Morocco and Nigeria also recorded strong gains. (See Chart 4)

Chart 4: R&D trends in selected African Economies

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information). This chart includes all African economies classified under the UN regions of Northern Africa and Western Asia (NAWA), as well as Sub-Saharan Africa (SSA).

Stylized Fact 4: China Drives a Shift in Global R&D Shares

To no surprise, China's gripping rise in R&D spending – from 4% of global R&D in 2000 to 26% in 2023 – has significantly altered global R&D distribution. In turn, the share of high-income countries has declined from 87% in 2000 to 63% in 2023. Excluding China, the upper-middle-income group has stagnated at 6% over the same period. Lower-middle-income economies, led by India, Egypt and Viet Nam, have grown their share from 3% to 5%. The share of low-income economies remains negligible, despite progress in certain individual countries (see Annex Table 1).

On a country-level, apart from China, the countries with the biggest increase in global R&D share between 2000 and 2023 are: Republic of Korea, Türkiye, India, Egypt, Thailand, Poland, Indonesia, Saudi Arabia, and Israel. The economies with the biggest decrease in global R&D shares are: United States, Japan, Germany, France, Italy, Canada, Russian Federation, Brazil, Sweden, and Netherlands (Kingdom of the Netherlands). (See Chart 5)

Chart 5: Top Gainers and Losers in Global R&D Share, 2000-2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Global R&D trends – Who are the 15 top R&D spenders worldwide?

Stylized Fact 5: The United States and China Dominate Global R&D Spending

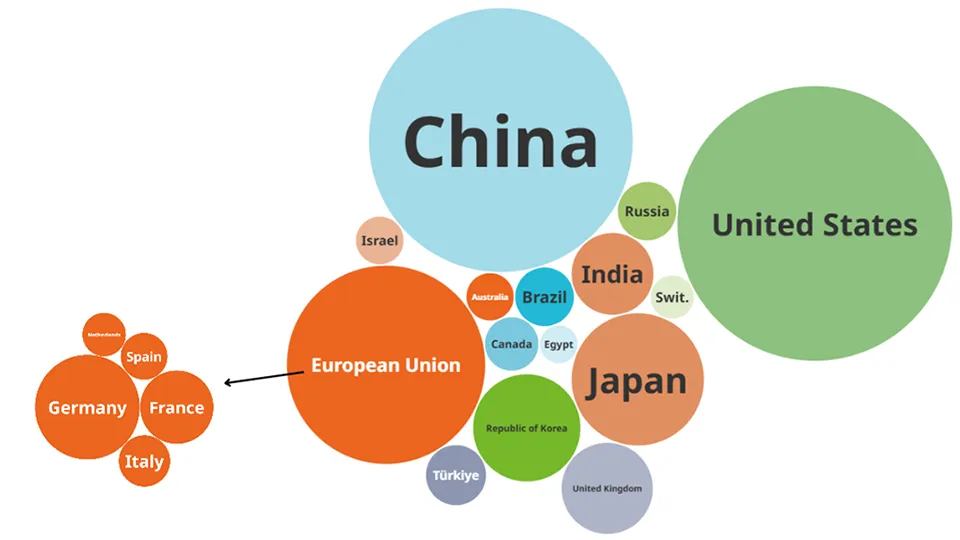

The United States leads global R&D spending with nearly USD 784 billion in 2023, closely followed by China at USD 723 billion. The gap between these two leaders and the rest is substantial. Japan ranks third with about USD 184 billion (a quarter of China's spending), followed by Germany with USD 132 billion (less than a fifth of China's), the Republic of Korea (less than a sixth of China's), the UK at USD 88 billion (less than an eighth of China's), and India with USD 71 billion (about a tenth of China's). When grouped as a single entity, the European Union's total R&D expenditure is a little over one half that of the US and China, at approximately USD 410 billion. (See Chart 6)

Chart 6: The top global R&D spenders, 2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Stylized Fact 6: Middle-Income Economies Rise Among Top Global R&D Spenders

The top 15 global R&D-spending economies now include several middle-income nations, notably China, India, Türkiye, Brazil, and the Russian Federation. If the European Union is treated as a single entity in the top 15, Egypt makes this group. This marks a significant shift in the global R&D landscape. (See Table 1). In the European Union, the top R&D spenders in 2023 are Germany (132 billion USD), France (65 billion USD), Italy (32 billion USD), Spain (27 billion USD) and the Netherlands (23 billion USD).

Table 1: The top 15 global R&D spenders, 2023, in USD 2015 PPP

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Global R&D trends – Which economies have seen the fastest R&D spending growth over the last two decades?

Stylized Fact 7: Middle-Income Economies Dominate Fastest-Growing R&D Spending

As a corollary to fact 6, the list of the fastest-growing R&D spenders is almost exclusively composed of middle-income economies, with the notable exception of Saudi Arabia, Malta and Cyprus (See Chart 7). Leading the pack is China, which has increased its R&D spending by a staggering factor of 18 between 2000 and 2023. Ecuador and Saudi Arabia follow closely, each with a growth factor of 14, trailed by Egypt (factor of 13) and Indonesia (factor of 12). Additional notable countries include Thailand, Cambodia, Türkiye, Viet Nam, and Ethiopia, though their R&D levels vary significantly. Among these, only Türkiye, Thailand, and Indonesia have surpassed USD 10 billion in R&D spending in 2023. For a more complete picture of all the economies, see Annex Table 2.

Chart 7: Economies with the fastest R&D spending growth, 2000-2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Stylized Fact 8: High-Income Economies Saudi Arabia, Malta and Cyprus are R&D Growth Leaders

Among high-income economies, countries such as Saudi Arabia, Estonia, Republic of Korea, and Poland lead the R&D spending growth, which have grown by about a factor of 5. (See Chart 8). Some of the slowest R&D growth performers among high-income economies are Canada (1.48%), Norway (1.43%), Japan (1.40%), France (1.33%) and Finland (0.78%).

Chart 8: High-income economies with the fastest R&D spending growth, 2000-2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, Ricyt, and UNESCO UIS (see background information)

Global R&D trends – Which are the most R&D intensive economies?

Stylized Fact 9: Israel and Republic of Korea Lead in R&D Intensity

Israel and the Republic of Korea are exceptional outliers in how R&D intensive their economies are, with R&D expenditures at approximately 6% and over 5% of GDP, respectively. Globally, a total of nine countries exceeds the 3% R&D-to-GDP threshold, including the US, Belgium, Sweden, Japan, Switzerland, Austria, Germany and Finland. A total of 18 countries exceeds the 2% threshold, including Finland, UK, Denmark, Iceland, China, the Netherlands, France, Singapore and Slovenia. Among middle-income economies, China stands out as the only country surpassing the 2% threshold. It is followed by Türkiye (1.32%), Thailand (1.21%), Brazil (1.15%), and Egypt (1.02%), which have R&D-to-GDP ratios above 1% (See Chart 9 and Annex Table 3).

Chart 9: R&D-intensity for selected economies, 2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Stylized Fact 10: Still, R&D Intensity is Below or Far Below 1% in countless countries

Beyond the top performers, R&D intensity is below 1% across many economies. Countries such as India, Viet Nam, Kenya, Chile, and the Philippines often have R&D-to-GDP ratios well below 1%, with many nations falling under the 0.5% threshold. Approximately 66% of economies have R&D-to-GDP ratios below 1%, and close to 50% are under 0.5%. This highlights a stark disparity in R&D intensity across the globe (see Annex Table 3).

Global R&D trends – Which are the economies in which the private sector drives R&D?

Stylized Fact 11: Economies Where the Private Sector Drives R&D

In some economies, the private sector overwhelmingly drives R&D. Israel leads the way, with the private sector responsible for 92% of total R&D, followed by Viet Nam (90%), Ireland (80%), and both Japan and the Republic of Korea (79%). The private sector also plays a significant role in the US, China, several European economies, Thailand, Singapore, Türkiye, Canada, Australia, the United Arab Emirates, and others, where it contributes over half (50%) of total R&D. (See Chart 10)

Conversely, the private sector accounts for less than a quarter of economy-wide R&D in Kenya (16%), Rwanda (5.8%), and Egypt (2.7%), for example.

Chart 10: The share of private in total economy-wide R&D, 2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Background

To the surprise of many, reliable and up-to-date data on R&D—often considered a fundamental innovation indicator—is not readily available for all economies, let alone for recent years like 2023. To address this gap, the WIPO GII team works to provide a comprehensive global view of innovation and inform country rankings by leveraging data and estimates from esteemed institutions such as Eurostat, the Ibero-American and Inter-American Network of Science and Technology Indicators (RICYT), the New Partnership for Africa's Development (NEPAD) Agency, the African Union, the Organization for Economic Co-operation and Development (OECD), and the UNESCO Institute for Statistics (UIS).

We extend our sincere gratitude to the following colleagues: UNESCO Institute for Statistics (UIS): Rohan Pathirage and José Pessoa, OECD: Fernando Galindo-Rueda and Fabien Verger, RICYT: Rodolfo Barrere and Laura Trama, and African Union Development Agency-NEPAD: Lukovi Seke.

The GII itself incorporates R&D data across various dimensions, using a total of three indicators. For example, the US GII Economy Profile available on the novel GII Innovation Ecosystems & Data Explorer highlights specific official R&D statistics such as:

- 2.3.2: Gross expenditure on R&D (GERD) as a percentage of GDP

- 5.1.3: GERD performed by business, as a percentage of GDP

- 5.1.4: GERD financed by business, as a percentage of GDP

Annex Table 1: World's R&D Shares in 2000 vs. 2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Annex Table 2: Economies by R&D Growth (CAGR), 2000-2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Annex Table 3: Global ranking of economies by R&D intensity (GERD as a % of GDP), 2023

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)